London, October 9th 2024 – Concirrus, the leading AI-powered solution for the insurance sector, proudly announces the launch of its cutting-edge construction insurance product, set to change how insurers assess and manage risk in the construction industry. This innovative module, capable of processing a submission in just 90 seconds, marks a significant milestone in Concirrus’ ongoing mission to modernise insurance through state-of-the-art technology.

The construction sector, characterised by its intricate and multifaceted risk environment, demands a sophisticated approach to insurance. Concirrus’ new product is specifically designed to address these challenges by harnessing AI, real-time data, and advanced analytics, offering insurers unparalleled insights into risk. This empowers insurers to make more informed decisions, reduce losses, and ultimately enhance profitability.

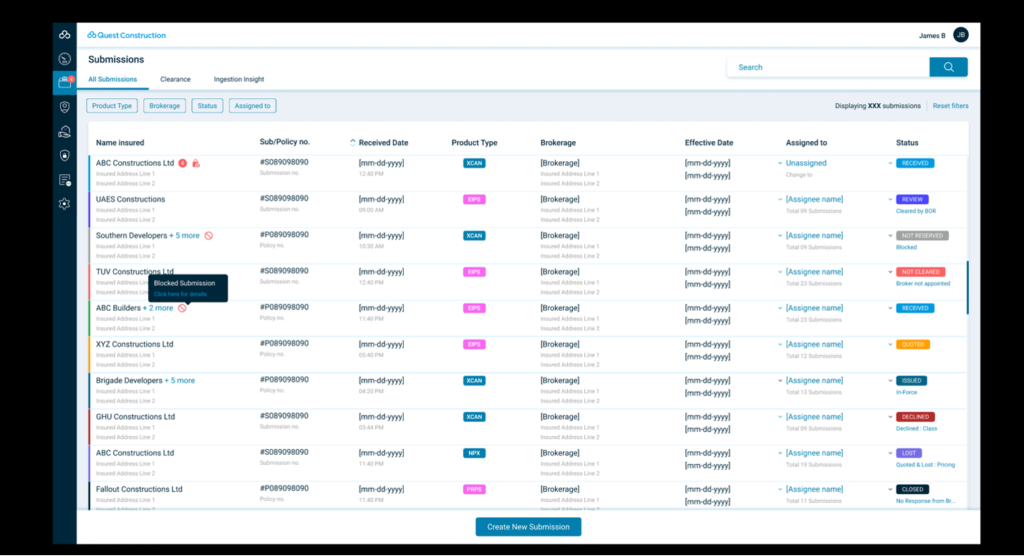

Key features of Concirrus’s new construction insurance module:

- Automated Data Ingestion: Streamlines the submission process by automatically extracting and ingesting data, reducing manual entry and enhancing accuracy.

- AI-Powered Risk Scoring: Leverages AI and machine learning to evaluate risk factors, providing instant risk scores to aid underwriters in decision-making.

- Customisable Submission Templates: Allows for the creation and customisation of templates tailored to specific lines of business, ensuring a consistent and efficient submission process.

- Real-Time Analytics and Insights: Delivers real-time data on submission trends, underwriting performance, and market opportunities, enabling data-driven decision-making.

- Seamless Integration: Easily integrates with existing insurance platforms and other Concirrus modules, ensuring a unified workflow with minimal disruption.

- Collaboration Tools: Enhances team communication with comment threads and shared workspaces, reducing bottlenecks in the submission process.

- Enhanced Compliance and Audit Trails: Provides comprehensive audit trails and compliance with industry regulations, ensuring transparency and security throughout the submission lifecycle.

- Scalability and Flexibility: Designed to scale with growing business needs and adaptable to various insurance lines, making it versatile for diverse requirements.

- Enhanced Data Security: Adheres to the highest cybersecurity standards, protecting sensitive construction project information and maintaining customer trust.

- Customisable Dashboards: Offers insurers an intuitive, user-friendly interface to visualise key risk indicators and project performance, facilitating better decision-making.

Christopher Day, President of Applied Specialty Underwriters, LLC, shared his enthusiasm for the new product, stating, “In my 33 years in the business and 20 years of leadership, I would tell you that Concirrus has been one of the best development teams that I have worked with. Concirrus is integrating AI-powered solutions into our workflow, which will result in huge productivity gains for us.”

Andrew Yeoman, Co-Founder and CEO of Concirrus, added, “We are thrilled to introduce our construction-focused submission module, which addresses the specific challenges faced by insurers in this vital industry. Our commitment to innovation is embodied in this offering, which will enable insurers to better understand and manage construction-related risks, leading to stronger, more resilient portfolios.”

Concirrus’ new construction insurance product is now available to clients worldwide. For more information, please visit Concirrus’ website.

About Concirrus:

Concirrus is trusted by leading specialty insurers in Marine, Aviation, Construction, and Transportation to enhance efficiency throughout the insurance lifecycle—from acquisition to renewal. We automate processes such as submission ingestion, compliance checks, ESG monitoring, and portfolio management, allowing underwriters to focus on value-added activities. This results in increased operational efficiency and faster business acquisition.

Press Contact:

Jordyn Armstrong, Marketing and Demand Generation Manager, Concirrus